On a mid-June weekend, Raquel Urbina made seven trips to Milwaukee-area grocery stores in search of the hypoallergenic baby formula she needs to feed her 10-month-old daughter.

She had little time to spare. Her monthly supplemental nutrition benefits through the state’s Women, Infants, and Children (WIC) program were set to expire in a few days.

On that Sunday, she finally succeeded in what felt like a “treasure hunt.” She found four cans of Reckitt Mead Johnson’s Enfamil Nutramigen formula at a Walmart in Greenfield, Wisconsin, about 10 miles from her home.

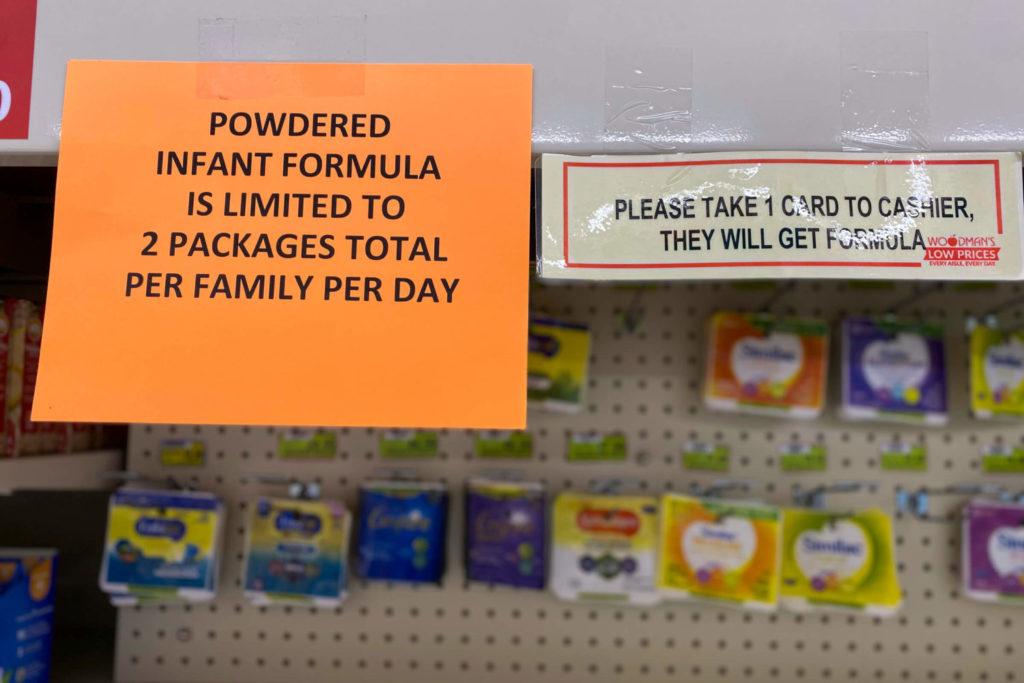

Stressful hunts for baby formula have dominated life for months for millions of parents and caregivers who rely on it to feed their children.

The formula shortage resulted from pandemic-related supply chain issues and two shutdowns of an Abbott Nutrition plant in Sturgis, Michigan — first amid an investigation into reports of bacterial infections and more recently due to flooding. Federal rules require WIC programs to choose one vendor to provide formula, and Abbott is the sole supplier in most states.

The shortage affects parents of all backgrounds, but Urbina and others who navigate formula purchases through WIC face particular challenges. Not all retailers accept WIC, and before parents try to find formula in stores, they must first confirm which products the state allows them to buy with their benefits.

Options limited in WIC

Under Wisconsin’s contract with Abbott that began in 2021, WIC participants can normally spend their benefits only on five Abbott-manufactured Similac formulas unless they request a special medical formula.

The Wisconsin Department of Health Services, which administers WIC, allowed parents to purchase other brands and sizes of formula soon after Abbott’s recall, but even locating scarce substitutes has proved difficult.

Some parents have formed online communities to help, including the Milwaukee Formula Parents Facebook group, of which Urbina is an administrator. She helps approve posts in the group, where more than 3,000 members swap tips, offer up extra cans and post photos of grocery store aisles to alert parents about what is in stock.

Activity in the group suggests that Nutramigen remains especially hard to find. That complicates life for Urbina, who switched brands at her doctor’s suggestion following Abbott’s recall of certain cans of Similac Alimentum, which she previously used.

But the only state-approved alternatives for Nutramigen are larger sized containers, not different brands — which Urbina didn’t learn until weeks after the substitutes were announced. Had she remained on the Abbott brand, she would have more options.

“It was discouraging, because as much as I understand that Similac parents were affected, I was a Similac parent at one point and so I had to switch to Nutramigen. And now I’m affected as well,” Urbina said. “I’m not given options, I’m not given alternatives.”

Roots of a crisis

How could one plant’s troubles so severely crimp the nation’s infant formula supply? The challenges are rooted in the market’s consolidation, WIC officials and experts say.

“With one manufacturing plant being closed for a few weeks, it should not have this scale of a threat to the supply that our parents are facing right now,” said Camen Haessig, who chairs the Wisconsin WIC Association and directs the Wood County Health Department’s WIC program.

States began signing exclusive contracts with formula providers decades ago to secure large rebates — a trend that began amid worries about rising formula costs. Three companies hold the contracts across all states to provide formula through WIC, which accounts for about half of all infant formula purchases in the country.

Abbott, which did not respond to requests for comment, exclusively provides formula to WIC programs in two-thirds of states. Reckitt Mead Johnson and Gerber serve the remaining states.

While consolidation in the formula market existed before the contract system, smaller companies have found it difficult to compete.

The ripple effects from Abbott’s disruption illustrate the market’s vulnerabilities, prompting policymakers to consider how to prevent a future crisis.

Exclusive contracts bring savings and risk

Since 1989, the federal government has required states to pick one formula provider for WIC — or find an alternative way to save equally on costs. States continue to choose a single provider, thus limiting choices for enrollees. They award contracts to the manufacturer who bids the lowest net price: the wholesale formula price minus rebates for each container of standard formula that WIC families purchase.

The rebates enable Wisconsin to serve all eligible enrolled participants without a waiting list.

“For more than 20 years WIC has not turned away eligible applicants or put them on a waiting list due to lack of funds,” according to the Center on Budget and Policy Priorities, a progressive-leaning think tank.

In Wisconsin, about 84,000 people participated in WIC in April. Nutritional risk, household size and income level help determine eligibility: a Wisconsin family of two making up to $33,874 annually can qualify, under DHS’ most recent standards.

In 2021, the state saved $20.3 million in rebates through the contract with Abbott. Nationwide, yearly savings from rebates are around $1.6 billion, supporting one in four participants each month, according to the U.S. Department of Agriculture.

Even manufacturers who offer the most generous rebates benefit from the state contracts, which increase their brand’s visibility, reputation and availability — giving products more shelf space and even increasing sales to parents not enrolled in WIC.

Abbott offers Wisconsin a range of rebates, up to 134% of the wholesale price for the powdered form of Similac Advance, a basic formula. The company is also giving discounts — some as high as 186% — on substitutes through August 31.

But alongside the economic benefits of rebates, the current shortage illustrates that exclusive contracts have “posed a lot of challenges,” Haessig said.

“When few companies — with highly centralized operations — command the overwhelming majority of the domestic infant formula supply, a single plant being shuttered for a few weeks can have catastrophic effects,” DHS spokesperson Elizabeth Goodsitt wrote in response to emailed questions.

Changing the bidding process could give participants more options, Goodsitt wrote, but the “financial trade off is unknown.”

Experts warn that abandoning exclusive contracts could increase program costs and jeopardize the state’s ability to serve everyone who is eligible.

Splitting out some of the contract or allowing a second company to join in the bid could help diversify the industry, said Steven Abrams, a professor of pediatrics at Dell Medical School at the University of Texas at Austin.

“But I think everyone’s got to be honest, it’s going to cost money because companies are unlikely to give the same level of rebates,” Abrams said.

Investigating consolidation, preventing future shortages

Federal officials have voiced concerns about the infant formula industry’s lack of competition and supply vulnerabilities.

The Federal Trade Commission in May launched an inquiry of issues such as the effects of state WIC contracts on the formula market, families’ experiences purchasing formula through WIC and the impact of mergers and acquisitions.

The FTC said it will evaluate the results of its inquiry with the USDA to consider policies that boost market resilience.

The agency also investigated the formula industry in the early 1990s. A district court ruled in Abbott’s favor after the FTC sued the company, alleging that it conspired with others to rig the bid for Puerto Rico’s contract. Two other companies gave the federal government 3.6 million pounds of formula through a settlement of lesser complaints.

In its new inquiry, FTC solicited public input for a month and received just over 300 comments through late June, with multiple suggesting re-examining bidding practices.

Allowing WIC to contract with more than one company would benefit the program, the Wisconsin WIC Association commented. The National WIC Association called for “stronger, more uniform terms” in contracts to ensure that manufacturers are prepared when supply challenges arise.

In May, President Joe Biden signed the Access to Baby Formula Act, which requires new or renewed WIC contracts to include a manufacturer’s contingency plans for recalls, including how a manufacturer would protect WIC participants from disruptions.

But that protection won’t immediately affect Wisconsin’s WIC program, whose contract isn’t up for renewal until 2026.

Goodsitt said DHS is exploring intermediate steps, such as amending the contract to include contingency plans.

‘When it’s rigid, it breaks’

While the formula substitutions will be available at least through August, advocates hope that WIC will extend flexibilities for other foods and services that the federal government allowed during the pandemic.

WIC has “rapidly adapted” within months to ensure formula access during the shortage, the National WIC Association wrote to the FTC. “This significant shift in program services must translate to long-term stability.”

Aside from infant formula, nutritional services and health care referrals, WIC provides access to fruits, vegetables and other nutritious foods. During the pandemic, the federal waivers allowed Wisconsin to widen food access, including to milk with any fat content and different bread and juice sizes.

The pandemic showed that people needed flexibility to access needed nutrition, said Maureen Fitzgerald, vice president of government relations for Feeding America Eastern Wisconsin.

“WIC is a very prescriptive program. It is great for new moms and babies to get the nutrition that they need. But it’s also sometimes difficult because you have to have the specific brand and you have to have the specific size of that brand,” Fitzgerald said. “When it’s rigid, it breaks, frequently. And that’s what happened.”

During future emergencies, disasters and supply chain disruptions, the Access to Baby Formula Act allows USDA to adjust WIC program requirements, as long as the changes maintain nutritional quality.

USDA has extended most pandemic waivers until 90 days after the national public health emergency expires, which is expected to continue past mid-July.

The National WIC Association wants flexibilities to continue — including allowing participants to enroll or reenroll via phone or video. USDA early in the pandemic waived a “physical presence” requirement for applicants in all states. A bipartisan proposal in Congress to allow remote appointments permanently has yet to receive a hearing.

“Having those flexibilities has been so important for our families to be able to find our WIC items, because it is so specific,” Haessig said. “We are advocating and hoping that those will be extended. There’s a lot going on and going through Congress right now to advocate for those changes.”

The nonprofit Wisconsin Watch (www.WisconsinWatch.org) collaborates with WPR, PBS Wisconsin, other news media and the University of Wisconsin-Madison School of Journalism and Mass Communication. All works created, published, posted or disseminated by Wisconsin Watch do not necessarily reflect the views or opinions of UW-Madison or any of its affiliates.